There are plenty of questions, some clear-cut opportunities and few definitive answers. That’s where things stand with local school districts following last-minute action by the Washington State Legislature.

Shortly before they adjourned April 28, lawmakers essentially changed the rules of the financing game, allowing districts to collect more from property tax levies. The shift takes effect next year.

The action came in response to fallout created by previous legislation which left some schools – not necessarily Enumclaw or White River – bemoaning huge deficits that brought staff layoffs and, as a natural consequence, labor strife.

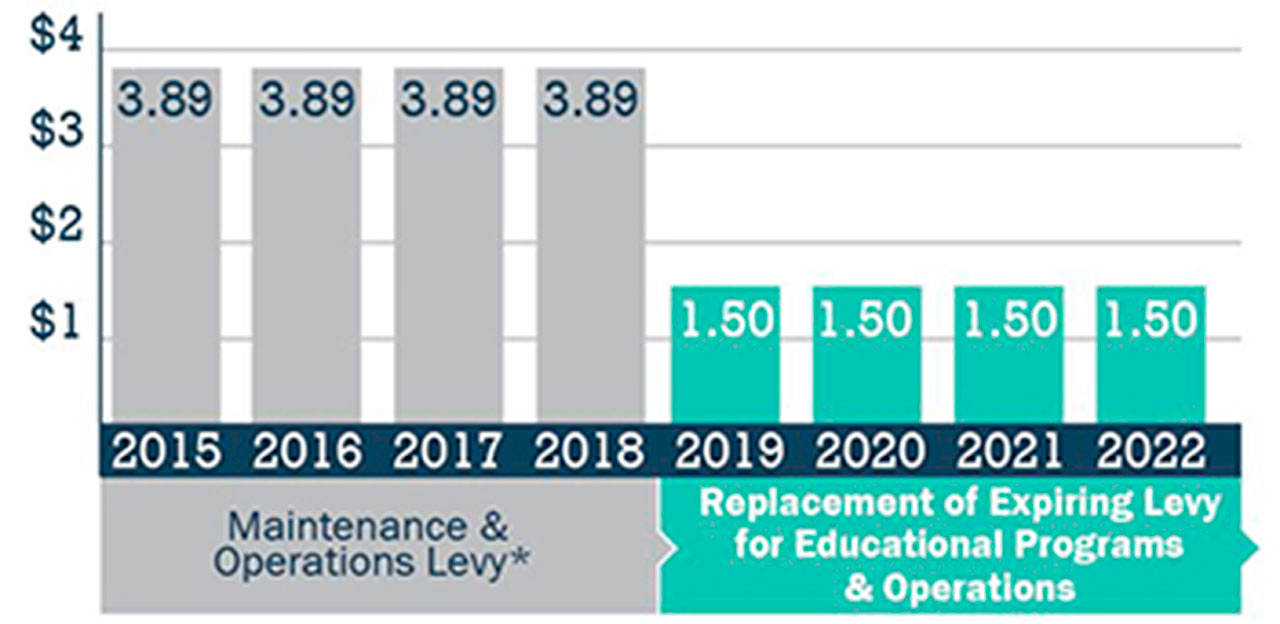

The well-documented McCleary case, which hung over several sessions of the Legislature, was resolved when the state Supreme Court ruled that Washington’s top priority is to fully fund the cost of education. As part of the process that sent money to districts throughout the Evergreen State, legislators placed a cap on the amount districts could collect from their constituents: local levies could account for $1.50 per $1,000 of assessed property value or $2,500 per student, whichever was less.

That left some districts, both large and small, arguing that the trade-off didn’t work. Complaints were lodged that some were losing money due to the arrangement hatched in Olympia.

Fast forward to the 2019 session, where legislators again battled with the issue of educating the state’s children in an equitable manner.

In the end, shortly before closing up shop and heading home, a bill was passed that allows local collections up to $2.50 per $1,000 of assessed property value.

“We’re still investigating what this means to us,” said Mike Nelson, superintendent of the Enumclaw School District.

Enumclaw is in a not-too-unusual position: district voters, in February 2018, approved a four-year levy at the $1.50 rate. Collections from that levy just began a few months ago, in January. The new legislation, however, allows districts to place another levy before voters that could push the collection rate to the new limit of $2.50.

“No one thought there would be such a change,” Nelson said, emphasizing that a lot of work needs to be done for options are delivered to the Enumclaw School Board.

It’s a similar story in the White River School District, where voters also approved a four-year levy in February 2018.

Assistant Superintendent Mike Hagadone said, late last week, that there had been no discussions with the school board regarding the new local funding option.

District Finance Director Donna Morey said White River is “still doing pretty well” because administrators and the board had previously taken a conservative financial approach. Still, she said, the district is looking at dipping into its financial reserves the next couple of years to make ends meet.

In the tiny Carbonado School District, Superintendent Scott Hubbard said the Legislature’s 11th-hour action can be seen as both good and bad news.

The positive side, he said, is that it allows districts to better fund programs through local control. But, he cautions, there’s a risk in asking too much of district property owners. That’s a worry even in tight-knit Carbonado, where voters have never failed to support a district request.