Ballots were received throughout four area school districts last week and voters have until Feb. 13 to determine if they will continue their support of local educational efforts.

Reaching out to the public are the Sumner-Bonney Lake, Enumclaw, White River and Dieringer districts.

Things have changed dramatically in the world of public education recently, with court-ordered efforts by the state Legislature to adequately fund K-12 learning. The days of the traditional maintenance and operation levy are gone; the new state-mandated term is “educational programs and operations.”

Either way, the effort is the same: school districts are seeking money for efforts that go above and beyond the state’s definition of basic education. As before, levies are not for new construction. The local requests would cover things like safety and security improvements, certain special education programs, athletics and activities, teacher training, early-learning opportunities and transportation that is not already covered by the state.

Because the state has stepped up its funding formula, school districts are dropping the amounts being sought in the upcoming levy requests. Here’s where things stand with the local districts.

ENUMCLAW

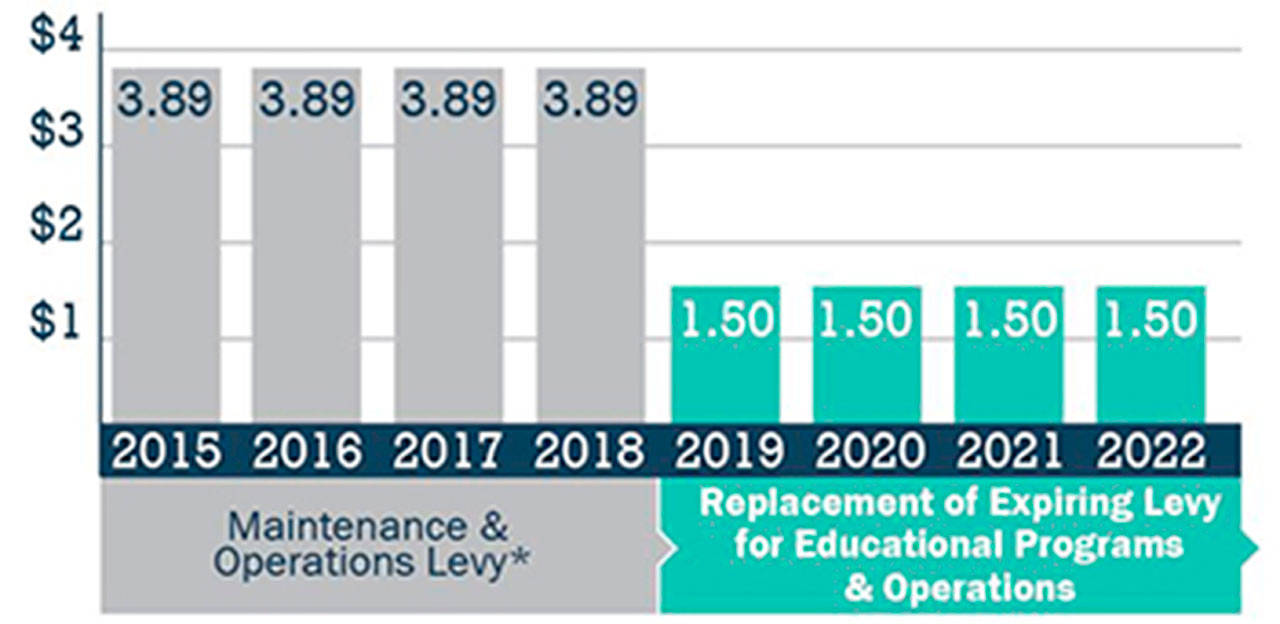

In February 2014, local voters approved a four-year maintenance and operations levy at a rate up to $3.89 per $1,000 of assessed property value. This time around, the district is seeking approval of a four-year levy that carries a rate of $1.50.

Passage would mean about $6.3 million to the district during the first year of collections, topping out at an estimated $9.6 million during the fourth year.

For the owner of property valued at $300,000, the annual tax bill for the expiring M&O levy is $1,167. With the lower rate of $1.50, the annual bill would be $450.

WHITE RIVER

White River voters approved a four-year M&O levy in 2013 that carries a rate of $3.45 per $1,000 of assessed value. District boosters point to the new rate of $1.50 – if the Feb. 13 levy is passed – and the decreased tax collections.

For the owner of a $300,000 property, the current tax amount is $1,035 annually. Like everywhere else, that would drop to $450 per year.

White River is different from others in that voters are being asked to also approve a “capital” levy. This would support technology improvements along with a handful of projects like improved parking at ElkRidge Elementary, replacement of the maintenance building at Glacier Middle School and added classrooms at the elementary level.

Also on the list is a new roof at White River High. The district points out that the roof is failing and causing leaks.

In the end, according to the district website, the combined rate – factoring in both bond and levy – will decrease from $5.88 per $1,000 of assessed value to a projected $4.77.

SUMNER

Voters here also will be deciding a pair of ballot measures: the educational programs and operations levy and a technology improvements levy.

Both are billed as replacements for levies passed four years ago.

This time, the programs and operation levy is a two-year request. The district website says it looks to collect $20 million in the first year and another $24 million in year two, but actual collection expectations are below $14 million both years, Communications Director Elle Warmuth said in a previous interview.

Like everywhere else, the levy is capped at a rate of $1.50 per $1,000 of assessed property value, meaning an annual tax bill of $450.

Supports note the current request carries a rate of about $1.81 less than is now being collected.

The technology levy is a six-year request that would add, on average, 47 cents per $1,000 of assessed value. That equates to $141 annually on property valued at $300,000.

DIERINGER

In the Dieringer district, voters will decide the fate of two levy proposals. The first is a programs and operation levy, the other a technology levy. Both replace current levies that were previously approved by district voters and, in each case, tax rates would remain essentially the same.

The program and operation levy now in place pays for approximately 30 percent of the district budget. In 2018, the district anticipates collecting $7.325 million through the levy that expires with the end of the year.

If the Feb. 13 levy is approved, collections are pegged at $6.65 million in 2019 and $7.25 million in 2020.

The district’s technology levy is a four-year proposal that aims to collect $1.725 million annually. The rate would begin at 86 cents per $1,000 of assessed property value and drop slightly the following three years.

Supporters of the technology levy say property owners “will not see a noticeable change” from existing tax bills.