Recreational marijuana was introduced to the Plateau a year ago when two retail stores set up shop on the outskirts of Buckley.

And coming this summer, The Green Door and Mr. Bills of Buckley will both be expanding their businesses to include stocking and selling medical marijuana. It is an option allowed to them by Senate Bill 5052, also known as the Cannabis Patient Protection Act, which was passed last July.

Both businesses applied and received their medical marijuana endorsement from the Liquor and Cannabis Board, and will start selling medical marijuana on July 1, 2016, when the final rules of the Cannabis Patient Protection Act come into effect.

What is medical marijuana?

Although the term medical marijuana will become more common as the Cannabis Patient Protection Act is solidified over the coming months, it’s actually a bit of a misnomer, because there is no real difference between medical and recreational marijuana.

“The only difference between medical and recreational marijuana is the intent of the user,” said Kristi Weeks, a policy counselor for the Washington State Department of Health. “Some strains or forms of marijuana may be more typically used by a medical patient, such as a very high CBD (or cannabidiol) and low THC strain (the psychoactive active ingredient of recreational cannabis). But they all come from the same plant.”

Despite the common use of the phrase, medical marijuana remains illegal under federal law, and does not have medication status; it cannot be prescribed by doctors or dispensed at a pharmacy, and stores are still not allowed to make medical claims concerning marijuana.

This is because the Food and Drug Administration has yet to approve marijuana as a treatment or medication, Weeks said, and stores and products will are required to disclaim that fact in some form.

To further prevent medical claims, stores with medical marijuana endorsements are allowed to advertise the fact that they have a medical endorsement and that they sell marijuana to medical patients, not that they sell medical marijuana, said Weeks.

While medical claims about marijuana are being avoided, the Department of Health will be identifying marijuana products that it deems to be beneficial to marijuana patients.

“The legislature asked us to define what products are beneficial for patients. A lot of people thought we were going to say, ‘this kind of marijuana is medical and this kind is recreational.’ And we can’t do that,” said Weeks. “So we listened to patients and what they have said over the years, in terms of what is important to them when they buy marijuana. They wanted products there are well tested, and have safe-handling, accurately labeled, things like that.”

Conditions and rules for medically-beneficial marijuana were made on Oct. 5 when the department filed emergency rules relating to quality testing. The rules expire after 120 days, but can be renewed.

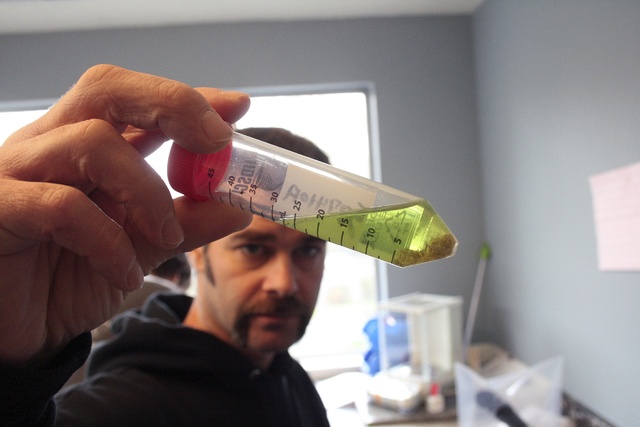

Currently, marijuana can be labeled as medically-beneficial for patients if it is tested for pesticides, heavy metals and mycotoxin.

There are also additional rules concerning sample size and how the marijuana is handled by producers and processors.

While the emergency rules are in play, the department is going through the formal rule-making process with the public, Weeks said.

“We anticipate the final, permanent rules will be issued in the spring,” she said. “They may be a little bit different after we’ve been listening to patient and industry feedback. But mostly the rules have been really well received.”

Marijuana producers that meet the Department of Health’s requirements for medically-beneficial marijuana can advertise this on their products, which can be purchased by both medical marijuana patients and non-patients.

Patient benefits

People who are qualified to become a patient are required to have a medical condition that is “terminal or debilitating,” Weeks said. The full list of qualifying conditions are listedin the Cannabis Patient Protection Act, and include HIV, multiple sclerosis, epilepsy, intractable pain, and any disease that results in nausea or vomiting.

The list also includes post-traumatic stress disorder and traumatic brain injury, which are new qualifying conditions.

A patient of one or more of these conditions, who is 18 or older, can be authorized by a doctor to use medical marijuana.

Patients who were authorized for medical marijuana before July 25, 2015 have to be re-authorized by July 1, 2016 in order to continue being a medical marijuana patient.

Patients approved on or after July 25, 2015 do not need to be re-authorized as a medical marijuana patient.

After receiving a doctor’s authorization, a patient may decide to log into a voluntary database of information for medical marijuana patients. Most of the benefits allowed to medical marijuana patients will only be available if a person is entered into the database.

Medical marijuana patients in the database will receive a state-issued identity card that can be presented at medical marijuana-endorsed stores for a number of benefits, Weeks said.

One benefit is not paying sales tax on marijuana, although patients still have to pay the 37 percent excise tax on marijuana.

This is because Washington voters approved Advisory Vote No. 11 on Nov. 3 by 59 percent, which kept the excise tax in place for marijuana bought by patients.

Additionally, medical marijuana patients in the database are allowed to purchase more marijuana at a medical marijuana-endorsed store than a non-patients.

Nonpatients are allowed to purchase one ounce of dried marijuana, 16 ounces of marijuana-infused edibles, 72 ounces of marijuana in a liquid form, and seven grams of marijuana concentrate at any one time.

Medical marijuana patients will be allowed to purchase up to three times the amount nonpatients can buy at any one time, varying by the form of the marijuana.

Card-carrying medical marijuana patients will be protected from being arrested for possessing or growing marijuana in excess of non-patients.

Medical marijuana patients can be arrested but can still use an affirmative defence in court.

Medical marijuana-endorsed stores can choose to donate marijuana to medical marijuana patients free of charge.

“If a patient is in the database, and they cannot afford the marijuana they use for medicine, a retail store with a medical endorsement can donate it to a patient or their designated caregiver,” Weeks said. “That is based on something we have heard, and the Legislature has heard, for the last several years, that a lot of patients cannot afford their medication.”

The donation will still be tracked as if it was a sale, Weeks continued, although there would be no cost to the patient.

Finally, medical patients can have access to products that have 50 mg THC per serving, as opposed to the 10mg THC per serving the rest of the public has access to.

“We heard from patients that they take up to 1000 mg a day of THC, and having to take it in 10mg doses was not going to work for them,” Weeks said. “They can purchase certain products that are up to 50 mg of THC per serving, but those are limited to capsules, tinctures, transdermal patches, and suppositories.”

Weeks said there will be no edibles with 50 mg THC per serving made available.

Additional legislative changes

It’s not just medical marijuana patients that may get a break in sales tax.

House Bill 2136 allows any marijuana product that the Department of Health deems medically beneficial to be sold without sales tax.

“These are products that won’t get you high,” Weeks said. “Any value they have is potentially medical, as opposed to recreational.”

Examples of products without an added sales tax for anyone, patient or not, includes edibles that have five times more CBD than THC.

For concentrates, there must be 25 percent more CBD than THC to reach the non-sales tax status.

“A lot of people have been confused and think those are the only ratios that a (medical marijuana) patient can have,” said Weeks. “It’s just a tax recognition status. Anybody can buy those products without paying sales tax.”