Do you have an opinion on what bond the Enumclaw School District should run next winter? If so, you have a few days left to submit your thoughts before any official decision is made.

The district is collecting community consensus through Thought Exchange, which bills itself as “the world’s number one anti-bias Enterprise Discussion Management Platform” — or, in other words, a better way to have focused community discussions than social media or surveys.

Thought Exchange allows you to anonymously submit your thoughts and rate the thoughts of others. The tool can translate all thoughts into your language preference so people of all backgrounds can participate in the discussion.

The Thought Exchange discussion on the bond ends July 1.

To submit your opinions, head to my.thoughtexchange.com/scroll/899950285/welcome.

THE BOND OPTIONS

Here are the three bond scenarios the Enumclaw School Board has put out to the community.

Scenario 1: This is what the district says is its “essential and immediate needs” — a new Byron Kibler Elementary/Birth to Five Center, a new Ten Trails Elementary, various maintenance and upgrades to existing facilities (all school buildings, the current high school auditorium and Pete’s Pool Stadium) and security upgrades.

The estimated combined tax rate of this bond scenario (which includes the current EP&O Levy tax, the current Technology Levy tax, and the remaining tax from the 2015 bond) is $4.18 per $1,000 in assessed property value.

Scenario 2: The “essential and immediate needs” of the district plus a new Performing Arts Center at the high school. This means the upgrades and maintenance to the older auditorium in Scenario 1 would not be performed.

The estimated combined tax rate of this bond scenario is $4.44.

Scenario 3: The “essential and immediate needs” of the district, a new Performing Arts Center, and a new athletic complex/stadium.

The estimated combined tax rate of this bond scenario is $4.60.

COMMUNITY THOUGHTS

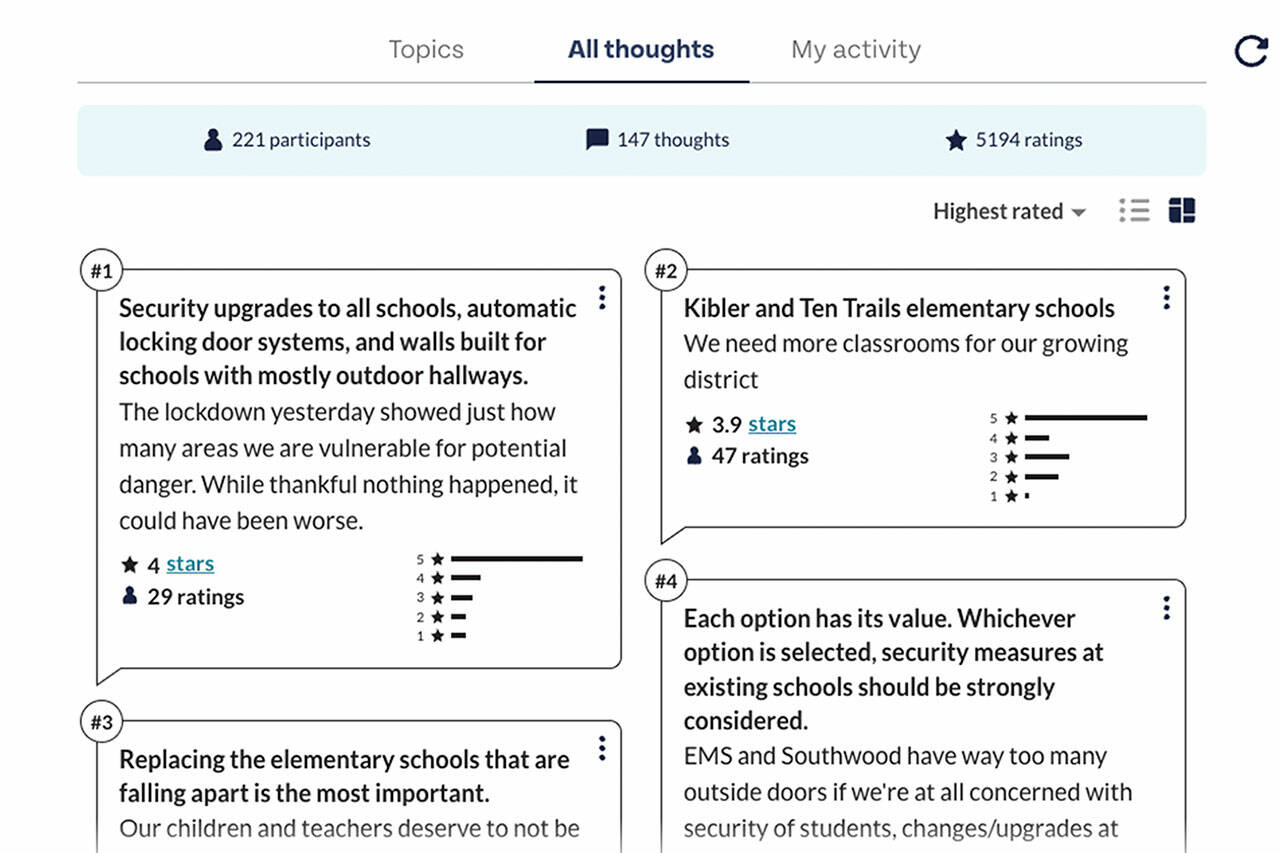

A number of higher-rated thoughts submitted by the Enumclaw School District community revolved around school security.

“Security upgrades to all schools, automatic locking door systems, and walls built for schools with mostly outdoor hallways. The lockdown yesterday showed just how many areas we are vulnerable for potential danger. While thankful nothing happened, it could have been worse,” one thought reads, referring to the June 8 lockdown of Enumclaw High and three other school buildings due to a teenager riding his motorcycle with weapons.

As of June 24, this thought was the highest rated thought out of 147 submitted.

“Each option has its value. Whichever option is selected, security measures at existing schools should be strongly considered. EMS and Southwood have way too many outside doors if we’re at all concerned with security of students, changes/upgrades at those buildings are needed,” reads a second, rated No. 4.

“Improving the security of EMS should be a priority as well. It has an outdated and open campus which is a significant safety concern,” reads a third, rated No. 7.

According to district PIO Jessica McCartney, the district is conducting safety audits at all school buildings to determine what security upgrades are necessary.

“This will help inform planning for potential security upgrades for next year, the design of future buildings, and how we can best allocate resources to support safety and security,” she said in an email interview. “The board is still in the planning process for presenting a bond to voters on the February 2023 ballot; the feedback they are seeking from the community will help inform their decisions.”

Some community members are also concerned that local development isn’t paying its fair share for these improvements and upgrades to the district.

“The need is great for a new school in Black Diamond, and updates to the old schools. But increasing property taxes 38% is a lot to handle. How can citizens afford the cost and what has been done to have developers pay for the growth?” reads one thought, rated No. 12.

“Developers should be paying for growth,” reads a second, rated No. 30.

McCartney pointed out that developers like Oakpointe in Black Diamond have already paid for some of this growth through a school mitigation agreement where, in short, developers had to give the Enumclaw School District money for every home built in the Ten Trail area.

The district then used that money, about $6.5 million, and purchased land in Black Diamond last December to be the future building site of the Ten Trails elementary and another potential elementary or middle school, depending on the area’s future needs.

“We know in other areas, where similar development has taken place, this same agreement was not in place resulting in significant challenges for the school district in obtaining available property in the area of new growth and the increased costs to purchase any available properties,” McCartney continued. “We are grateful for the planning done by the board and the district to have [the Oakpointe/Ten Trails] agreement in place so the construction of new homes pays for the property that will be used as future school sites.”

While only a small portion of the district community submitted an opinion or rating on Thought Exchange, bond Scenario 3 appears to be the most popular, with around 58 thoughts saying it’s the best option.

Bond Scenario 1 received the second-most support, with 35 positive mentions.

About 27 people submitted thoughts about hesitating to approve the bond or voting no, either because they or other people they know can’t afford the tax hike, or because developers should be paying more for this growth.

Bond Scenario 2 only received seven mentions of support.