CORRECTION: FCS reported incorrect information to the Black Diamond City Council when it came to being annexed into Mountain View Fire and Rescue’s district. According to FCS, if the city was annexed, its residents would have to pay a Maintenance and Operations levy of 30 cents per $1,000 in assessed property value on top of $1.50 per $1,000 in assessed property values in property taxes. This is incorrect — if the city was annexed, it would not have to pay that additional M&O levy. This article has been updated.

It’s certain — Black Diamond is going to need to pay more to continue receiving fire and emergency services.

But what does that mean for the average resident’s wallet?

The Black Diamond City Council discussed just that during a March 11 workshop with FCS Group, a firm the city hired to study on what options the city’s options when it comes to fire services, and how much those services will cost.

The two groups met late last year to discuss Black Diamond’s four options: continue contracting with Mountain View Fire and Rescue, annex into Mountain View’s fire district, annex into the Puget Sound Regional Fire Authority’s district, or form a city-owned fire department.

Every option is costly — some, though, cost less than others.

Currently, Black Diamond pays Mountain View about $615,000 a year for fire services.

But in order to keep receiving those services, Black Diamond will have to pay about $1.1 million more for a grand annual total of around $1.7 million.

And if you think that’ll hurt the city’s purse, just wait — the cost of starting its own fire department would increase city general fund spending by between $1.2 – $1.9 million, for an estimated annual total cost of between $1.8 – $2.5 million.

Of course, the city doesn’t just have an extra $2 million lying around, so FCS group expects the city to have to raise property tax levy rates to make up for the extra spending.

However, there are options that don’t require the city to spend money they don’t have — though Black Diamond would take a hit when it comes to losing property tax revenue.

For example, FCS group said it won’t cost the city annually to annex with the Puget Sound Regional Fire Authority’s district (which currently covers Covington, Kent and Maple Valley), but that’s because the city stands to lose about $1.1 million in property tax revenue if annexed, leaving far less for other city expenditures in its general fund.

Similarly, if the city were to annex into Mountain View, the city’s property tax revenue would fall by $1.7 million.

Even though the city has the property tax revenue to potentially afford either annexation option, though, a levy increase may still be necessary in order to retain current service levels.

With that primer, here’s what you can expect to pay in property taxes when a final decision comes around.

WHAT YOU CURRENTLY PAY IN CITY PROPERTY TAXES

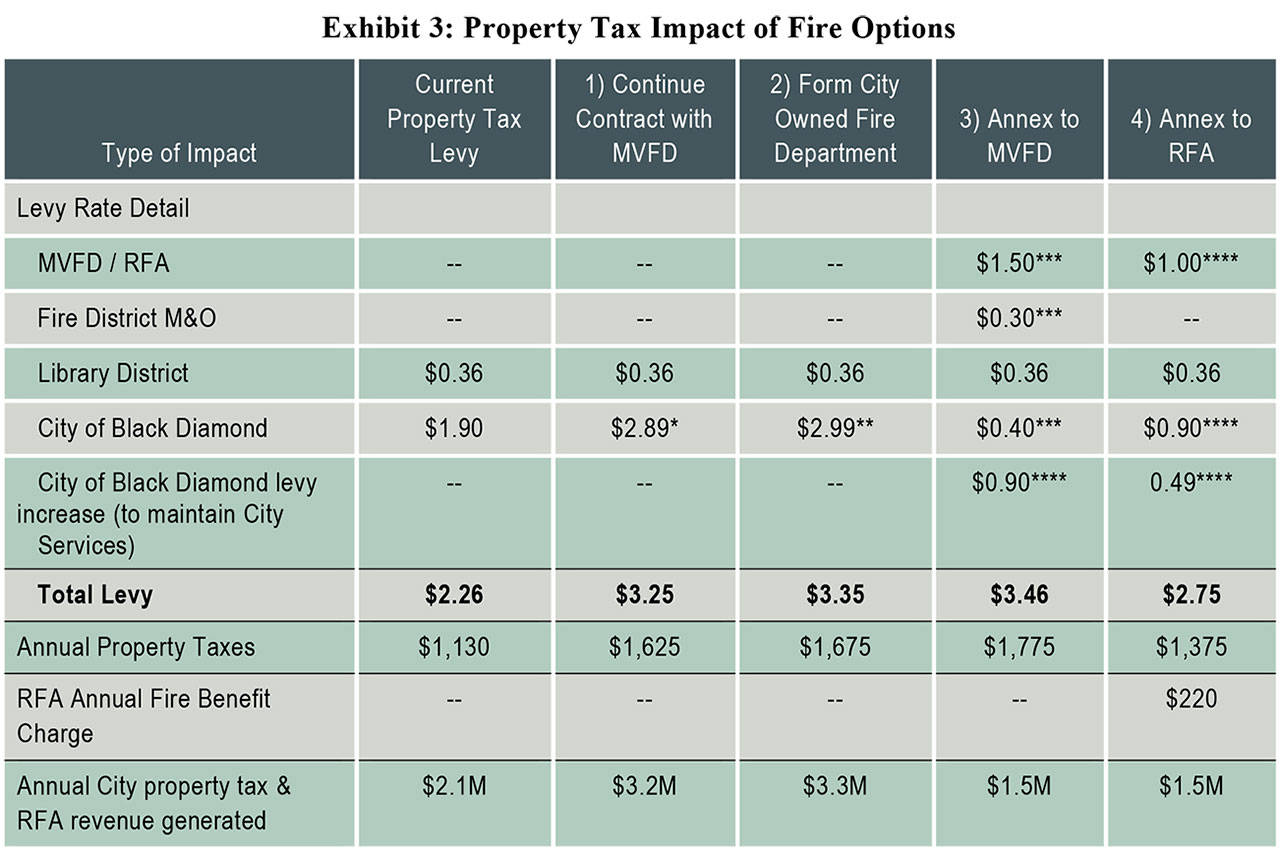

Currently, city residents pay $2.26 per $1,000 in assessed property value; $1.90 goes to Black Diamond, while the remaining $0.36 goes to the King County Library System.

On average, this means homeowners with a home worth around $500,000 pay roughly $1,130 in property taxes every year, generating $2.1 million for the city.

CONTINUE WITH MOUNTAIN VIEW

If the city decides to continue services with Mountain View Fire and Rescue, you can expect to add a few hundred dollars to your property tax bill.

According to FCS, this option will require the city to increase its portion of the property tax from $1.90 to $2.89 per $1,000 in assessed property value in order to both pay Mountain View and offer a similar level of city services to its residents.

Doing so, though, would increase the annual average property tax to $1,625, nearly $500 more than what the average resident currently pays. This would bring in a total of $3.2 million into city coffers.

However, the city doesn’t have the authority to just raise its property taxes — instead, the city council would have to ask voters to authorize it.

FORM OWN FIRE DEPARTMENT

Black Diamond would need to find only a little more revenue to form its own fire department rather than continue to contract with Mountain View.

According to FCS, the city would have to raise its portion of property tax from $1.90 to $2.99 per $1,000 in assessed property value to have enough revenue for its own fire department and continue offering other city services.

This would increase the property tax bill for the average city resident to $1,675 a year, and would bring $3.3 million into Black Diamond’s purse.

ANNEX INTO MOUNTAIN VIEW

Things start to get complicated when the topic of discussion is annexation.

First, the city’s portion of its property tax levy falls from $1.90 to $0.40 per $1,000 in assessed property value as $1.50 would then flow directly to Mountain View.

The city would then have to raise its portion of the property taxes by $0.90 (from $0.40 to $1.30) in order to retain current service levels.

FCS told Black Diamond council members that residents would also have to pay a $0.30 Maintenance and Operations levy that MountainView voters approved earlier, but fire chief Greg Smith said this would not be the case — “Voted levy measures… do not follow annexations or mergers, only those citizens who voted to approve an excess levy… pay for these excess levy.”

(In short, this means disregard the additional $0.30 levy in the photo attached to this article.)

If you didn’t follow the math, that’s fine — all together, residents would be expected to pay a total property tax levy of $3.16 per $1,000 in assessed property value, or an average of about $1,580 per year.

That would generate about $1.5 million in revenue for the city.

ANNEX INTO PUGET SOUND RFA

Getting annexed into the Puget Sound Regional Fire Authority isn’t just cheaper than annexing into Mountain View, but it appears to be the cheapest option of all four.

First, the city’s portion of its property tax levy would fall from $1.90 to $0.90 as $1 would be taxed directly by the fire authority.

However, the city would have to raise its portion of the levy from $0.90 back up to $1.39 in order to continue current services.

This means the final levy rate for city residents works out to be $2.75 per $1,000 in assessed property value, or an average of $1.375 a year.

This also would bring in about $1.5 million into city coffers.