Tax revenue is increasing, but Enumclaw is moving into a post-COVID federal funding area, which could shake up the city’s budget as it faces potentially-increasing deficits.

The Enumclaw City Council passed its 2024 budget on Nov. 27, and with it, some good and bad news from Mayor Jan Molinaro.

“This year’s budget started with caution and continues with surprises. Sales tax revenue continues to exceed the budget,” he wrote in the budget’s introduction. “What is not determined is how much of the sales tax increase is related to a natural increase or to inflationary increases due to retail stores raising prices. Probably both have influenced the increase. What has also increased due to inflationary pressures are the city’s expenditures. And this is where our challenge lies.”

The mayor went on to say the increases were caused, in large part, to 8% increases in wages and benefits for employees, and “some significant decisions” will need to be made in order to balance the 2025 budget.

“Will there be some pain in the coming months, hopefully not,” Molinaro continued. “Where it will land will need to be determined, but with the deficit the city is facing will require some extensive reviews that no one envisioned just a year ago.”

Budgets are often changed throughout the year based on unforeseen expenses and revenues, so the current budget is what’s expected to be brought in and spent.

REVENUES AND EXPENSES

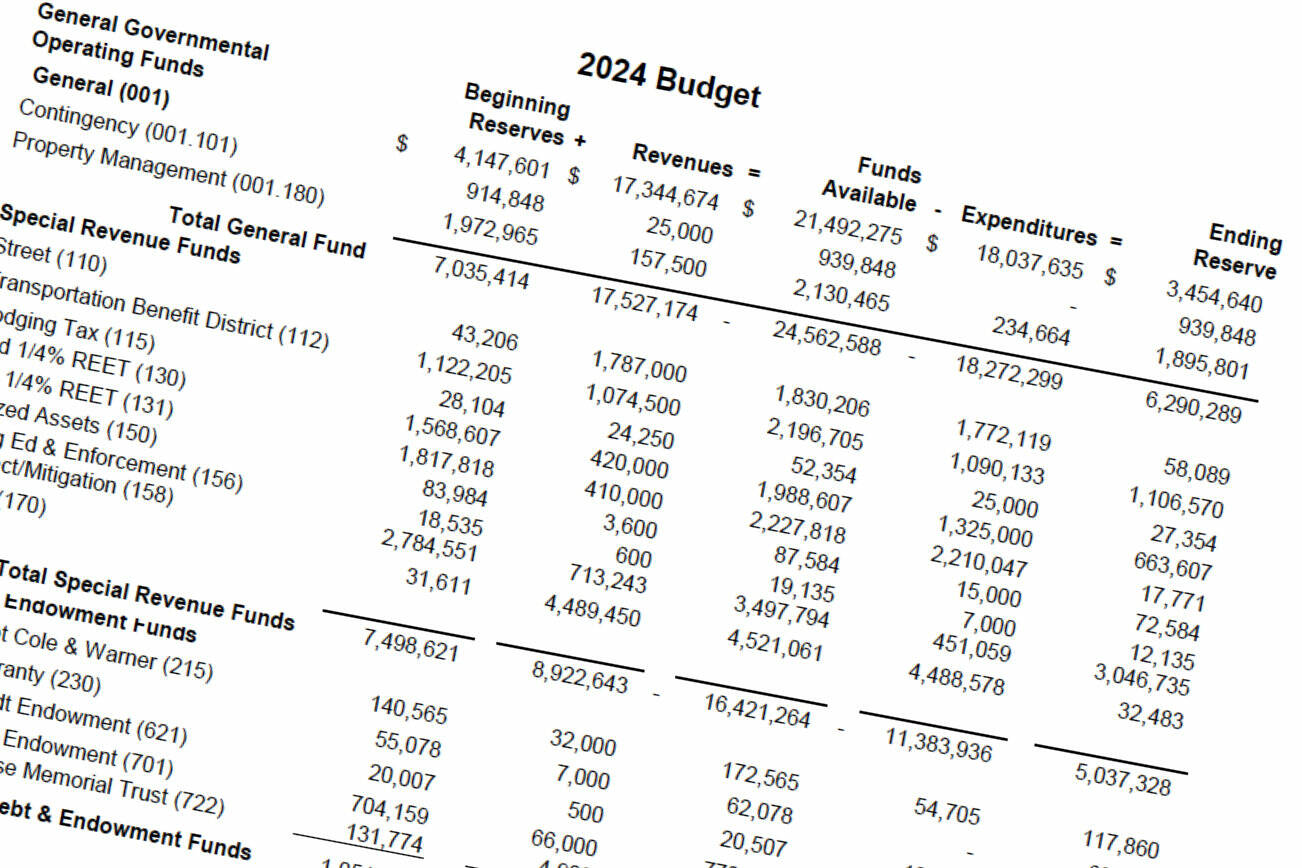

This year’s expected general fund balance is only slightly higher than last year’s, from $21.43 million to $21.49 million.

This appears to mark a slow-down in revenue and, in turn, beginning reserve funds, as the general fund was rising by multiple millions in recent years, from $10.77 million in 2020 to $18.11 million in 2022.

Total expected revenue is up, from $13.89 million in 2023 to $14.33 million this year. This increase is less than the actual revenue growth the city has seen since 2020, which grew between $750,000 to $900,000 each year.

However, expenses are outpacing revenue. This year, the city is expected to spend $14.61 million in operating expenses, compared to the $13.5 million last year (which more-or-less matched revenue), the $12.96 million in 2022 (which was a few hundred thousand dollars less than what revenue ended up coming into the city’s coffers), and the $10.5 million in 2021 (which was about $1 million less than revenue).

As Molinaro noted, the biggest increases in operating revenue were increases in salaries and personnel benefits. Additionally, budgeting errors contributed to a deficit of about $277,000 budget. If additional revenue isn’t found, the city plans to cover the deficit with ending balance reserves (which is $2 million higher than the city’s goal).

It’s unclear at this time what sort of budget deficits the city may face in the future, based on rising expenses. However, City Administrator Chris Searcy, the city will begin a multi-year projection of revenues and expenses next year to better consider different ways to sustainably balance the general fund.

“In the past we typically experienced more revenue and less expenses each year due to conservative estimating,” he continued. “Staff vacancies in the Police Department, and other General Fund departments to a lesser extent, also helped the bottom line.”

OUTSIDE FUNDING EXPENSES

Every year, the city of Enumclaw helps fund outside agencies like the Plateau Farmer’s Market, Visit Rainier, the local Chamber of Commerce, and more.

Since the COVID pandemic, American Rescue Plan Act (ARPA) funds were used to fund these agencies. Last year, the city spent $166,000 in funds, with only $24,000 coming from the city’s general fund seven nonprofits, plus another $30,000 to the Enumclaw Expo Center and Visit Rainier from the lodging tax fund.

This year, city spending increased to $130,000 due to the lack of ARPA funds.

The organizations receiving general fund grants are the Enumclaw Plateau Farmer’s Market ($10,000) for its food stamp support program; the Green River College Small Business Assistance Center ($5,000); the Rainier Foothills Wellness Foundation (60,000); Plateau Outreach Ministries ($30,000 for rental assistance, $15,000 for utility assistance); the Plateau Kids Network ($5,000); and 4H Junior Livestock ($5,000).

Organizations getting money from other funds include the Enumclaw Plateau Historical Society ($13,500); the Friends of the Enumclaw Library ($600); the Enumclaw Expo Center ($13,500); Visit Rainier ($11,500); and the Enumclaw Chamber of Commerce ($3,000).

LEVY INCREASE

This is the first time since 2014 that Enumclaw’s property tax rates on locals is increasing.

Enumclaw can tax residents up to $1.60 per $1,000 in assessed property value (which is different than market value). However, the city is only allowed, by state statute, to collect up to 1% in revenue every successive year — to compensate, then, the levy rate must decrease.

In 2020, the levy rate had fallen to $1.30 due to rising assessed value rates in the city; in 2021, $1.25; in 2022, $1.10; and in 2023, just $0.94.

However, the city’s assessed value fell from $2.68 million to $2.5 million while Enumclaw is looking to collect $2.72 million this year, about $180,000 over collections in 2023.

This means the property levy rate increased to $1.08.

The city’s rate is in addition to the other property taxes collected by the Enumclaw Fire Department, the Enumclaw School District, the King County Library System, King County, the state of Washington, and others.

BIG PROJECTS

As usual, Enumclaw has some large projects in the works to improve public facilities, utility services, streets, and more.

The most expensive, and probably the most exciting, project planned for this coming year is a $2.4 million pool renovation. Originally expected to be tackled in 2023, the renovation will make ADA upgrades to locker rooms, convert public restrooms to family changing rooms, construct a meeting/party room rental space, and updating the exterior front of the building, all without affecting services at the pool.

The project is partly funded with a $1.2 million grant from King County.

The pool is also going to get a new roof to the tune of $1.2 million (with a county grant of $526,000). City staff hope the roof replacement will start in August, during the pool’s annual week-long maintenance closure, though the closure might be extended.

Enumclaw is also expecting to replace the Boise Springs Transmission Main, which brings water from the spring lying to the east of the Enumclaw golf course to the city resevoirs next to the Crystal Mountain manufactured home community.

“The project will be in two phases: Phase 1 would be the section along SR 410 and is scheduled to be completed in 2024. Some impact to SR 410 traffic would be inevitable, but likely just a lane closure with alternating traffic,” said Searcy. “Phase 2 would be from SR 410 to the springs and include a crossing of Boise Creek in 2025.”

The project is expected to cost $2.15 million.

Also affecting traffic will be a $705,000 Roosevelt Avenue and 244th Avenue SE intersection improvement, where the city will be constructing a roundabout. This is expected to start June 2024 and will affect traffic, though Searcy noted school will be out when construction begins.

Other projects include street overlays, other water main replacements, waste water treatment plants renovations and replacements, and the design and permitting of a new sewer lift station.