Property value is always a fun topic, so with Buckley appraisals submitted, take a break from the sun and discuss it over dinner.

A June 23 Pierce County press release stated that average residential property values have dropped 3.1% countywide.

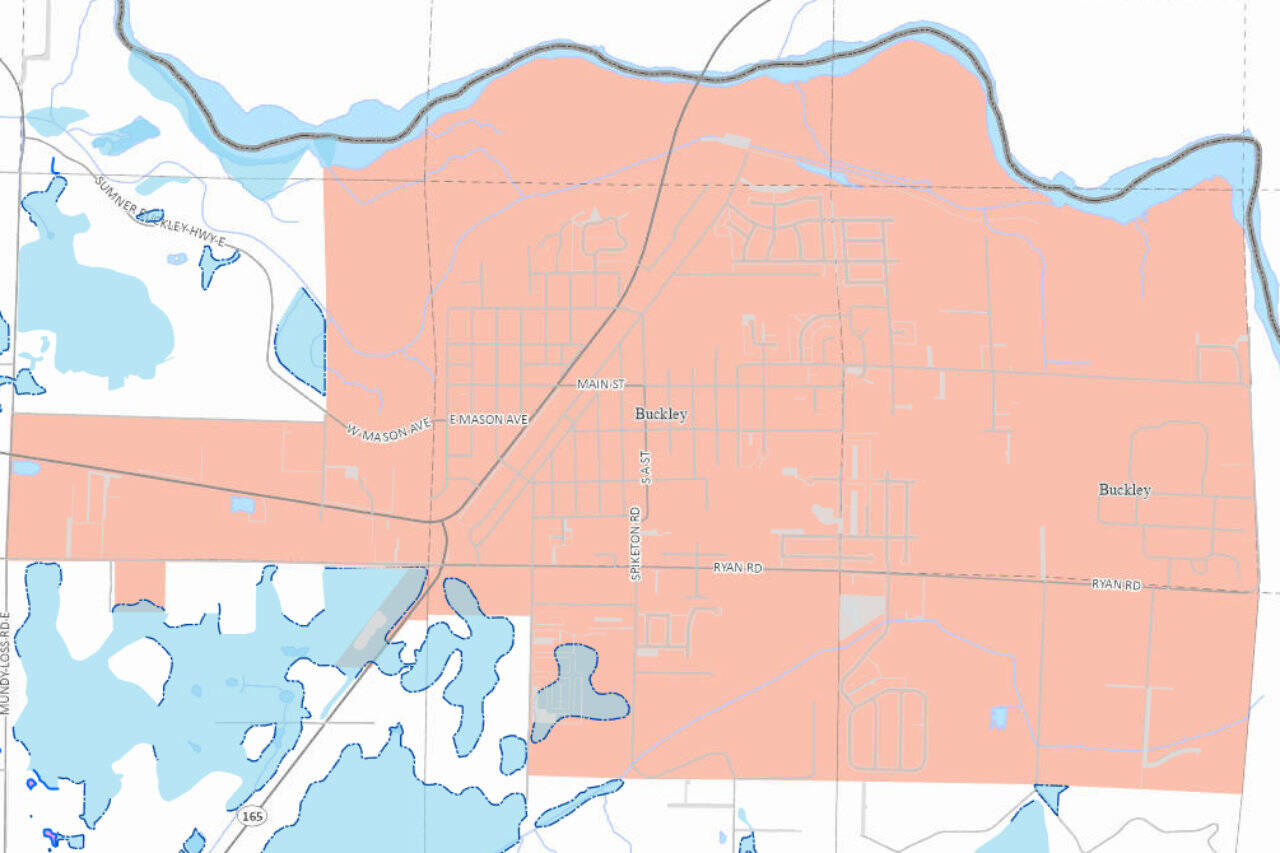

The percentage of property value decrease depends on the city. Buckley’s average assessed value dropped 3.9%, which could affect next year’s taxes, according to Mike Lonergan, Pierce County Assessor-Treasurer.

According to the press release, the latest assessed values for residential and commercial properties throughout Pierce County are in the mail to taxpayers and posted on the Assessor-Treasurer’s website.

The average Buckley home was assessed at $496,498 in 2022. This year, the city average dropped to $477,189, a $19,309 difference.

But just because assessed values dropped doesn’t necessarily mean your taxes will see a dip, too.

“Your property tax in 2024 will be the new 2023 value multiplied by the combined tax rates of your school district, city, fire district and other local districts, plus the statewide school levy that everyone pays,” Lonergan explained. “So a lot depends on public votes such as levy lid lifts and bond issues.” During the summer months, they are inspecting all new construction in Pierce County and adding its value to the tax rolls.

The change in home value varied in different communities based on actual sales of similar properties, according to the press release. 70% of home’s values dropped, while 30% stayed the same or rose slightly.

“The largest drops in value are around five percent in Tacoma, Ruston, Spanaway, Eatonville and Roy,” said Lonergan. The release said Milton had the highest value increase at 3%.

If owners believe their property was over-valued, they can appeal to the Pierce County Board of Equalization at no cost. The deadline to appeal is August 22, 2023. The press release requests evidence showing that comparable properties have sold at lower values. Information can be found here.